Managing personal finance can get stressful. But a number of apps are taking a swipe at making it a lot easier. These smartphone apps will help you track your expenses and save lots of money.

Here we go.

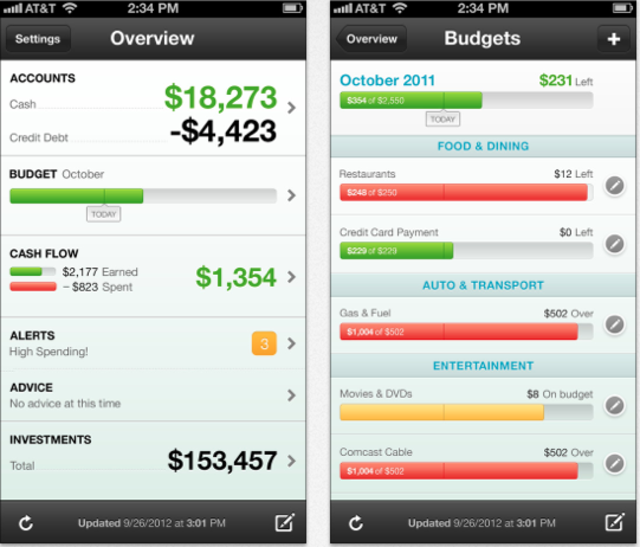

Mint

Everything is shown in simple, intuitive graphs and charts, making it one of the most popular personal finance apps in the world.

Acorn

Acorn says users invest $30 to $180 a month on average in “round ups” alone. But if you want, you can also invest a lump sum amount up to $30,000.

Level Money

It tracks your spending in real time, so you can easily see what you’ve spent and how much you can spend within a given period.

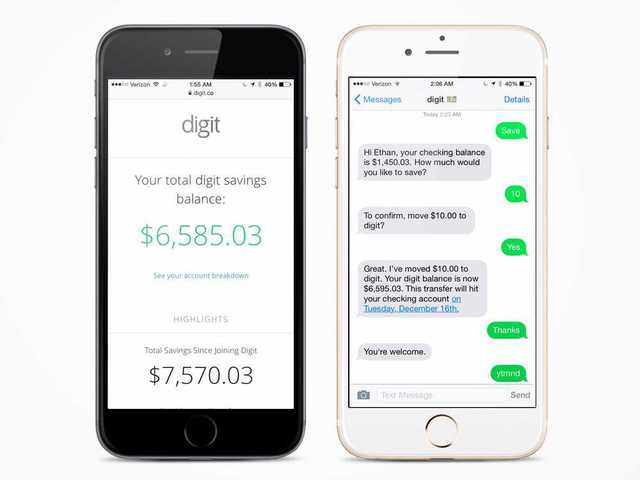

Digit

It officially launched in February and has Google’s backing.

You can sign up for it here.

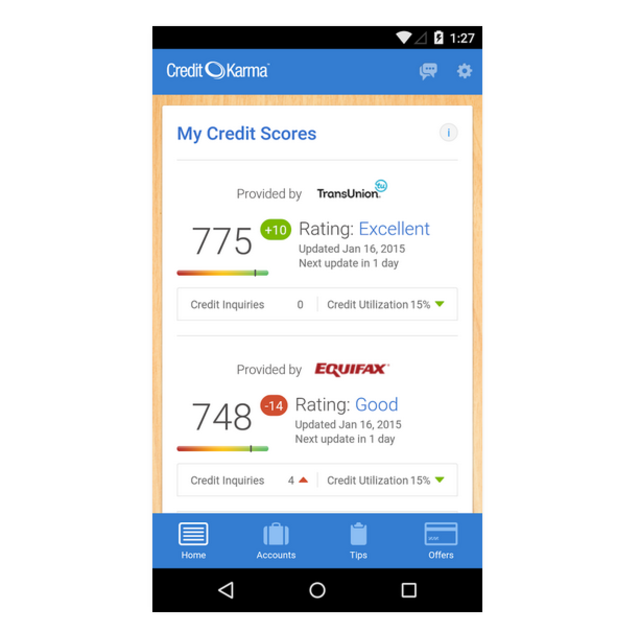

Credit Karma

Goodbudget

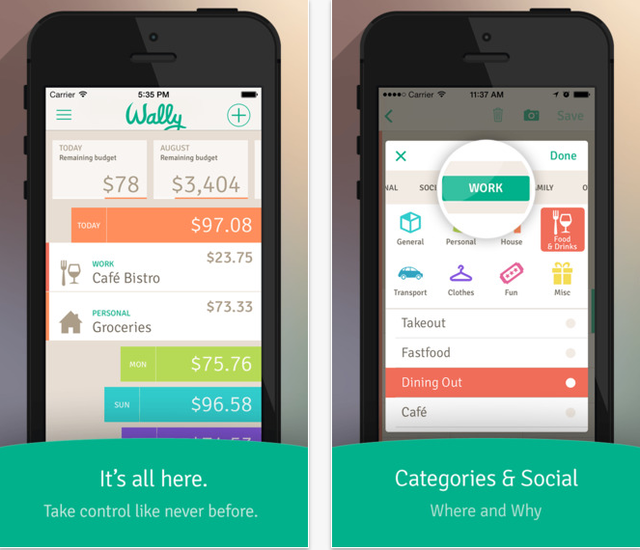

Wally

Most Read

Financial Planning for Women Is Now Mandatory.

Financial Planning for Women Is Now Mandatory. 10 Ways to Invest in your Health than Insurance.

10 Ways to Invest in your Health than Insurance. Star Health and Allied Health Insurance in detail

Star Health and Allied Health Insurance in detail All about the Oriental Insurance Company

All about the Oriental Insurance Company 5 Easy Steps To Buy The Best Car Insurance Plan.

5 Easy Steps To Buy The Best Car Insurance Plan. Super Top Up Plans: Best way to enhance health insurance cover.

Super Top Up Plans: Best way to enhance health insurance cover. HOW TO REGISTER YOUR PROPERTY ?

HOW TO REGISTER YOUR PROPERTY ? Tips For Choosing Right Health Insurance Policy.

Tips For Choosing Right Health Insurance Policy. 5 Reasons Every Road Tripper Must Have Personal Accident Insurance

5 Reasons Every Road Tripper Must Have Personal Accident Insurance